Why We Invested

Fernbrook ended 2022 on a strong note with the first mark-up in our 2022 vintage Fund II portfolio.

In December 2022, Archive Resale raised a $15 million Series A round led by Lightspeed Venture Partners, with Bain Capital Ventures, Fernbrook Capital, and G9 Ventures participating in the round. This round brings Archive’s total funds raised to $24 million, including its Q1 2022 $8 million Series Seed.

What Archive Does

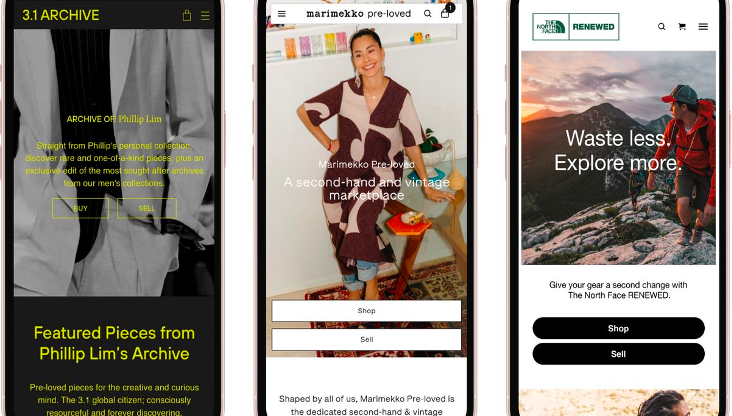

Archive builds best-in-class software applications that provide brands with a full operating system to launch and manage their own bespoke, white-labeled resale eCommerce program, while maintaining the same look and feel of their existing mainline site. It provides the software tools, data, and analytics, and has partnerships with logistics providers, all of which a brand needs to support its resale business via Archive’s own hyper-customizable tech stack.

Via Archive

Via Archive

Since Fernbrook first invested in Q1 2022, the Archive team has moved the business from a pure Peer-to-Peer (P2P) platform to providing its customers with an entire tech layer to build a complete resale ecosystem, including in-store takeback.

The Archive platform addresses and connects the three key functional areas needed for a successful resale business:

- Supply: online listing tools & resale store app;

- Logistics: resale warehouse management software; and

- Demand: branded resale site & store replenishment.

Archive generates revenue in two ways:

- Commissions on each sale; and

- Brand subscription and integration fees.

The Archive platform offers software solutions that incentivize the secondhand shopping process with a consumer experience comparable to the purchase of new products. This allows brands to incorporate resale into their business to increase customer loyalty and drive new revenue without increasing production.

Archive launched its operations in 2021. Since Fernbrook first invested in February 2022, Archive has launched three additional products with a strong roster of global brands, including The North Face, Sandro, and Marimekko.

Why We Invested

Compelling Founders

Co-founders, Emily Gittins, CEO, and Ryan Rowe, CTO, are an excellent team to scale Archive. Both have experience in the technology ecosystem at GoogleX and at successful start-ups. Prior to starting Archive, Emily earned a graduate degree in sustainability from Stanford and has worked on projects focusing on the creation of longer-lasting, more sustainable consumer products.

Archive’s co-founders Ryan Rowe & Emily Gittins via Archive

Archive’s co-founders Ryan Rowe & Emily Gittins via Archive

Ryan has deep experience in product strategy, UX design, and software development and engineering. He was the founder and CTO of Kimono Labs, which was acquired by Palantir in 2016.

Together Emily and Ryan have built a strong team of 23 from leading tech and consumer brand companies, including Palantir, Amazon, AfterPay, Patagonia, TheRealReal, and Nike. The company said it will use the funding to hire more employees for its engineering and branding teams and support its expansion in North America and Europe.

Large and Growing Market

Brands and retailers are accelerating their strategies for incorporating resale into their distribution channels and supply chains. Our research shows that resale has already become a huge online category, growing three times faster than new apparel sales.

The global secondhand apparel market has expanded from $49 billion in 2016 to $96 billion in 2021, and it is expected to reach $218 billion by 2026. In 2021, Archive estimated that 57% of consumers resold apparel. A recent ThredUp report noted that The RealReal, ThredUp, Poshmark and other third-party re-commerce platforms will make up 18% of the overall apparel industry by 2031. Plus, another report from WD Partners found that 92% of respondents said they buy, sell and trade used goods at least once annually. Archive believes its Serviceable Obtainable Market is about 5% of the $48 billion Total Addressable Market (2025 US Apparel Online Resale Market).

Most of this growth in the re-commerce market has been generated on third-party platforms. Fernbrook believes that the next phase of this growth will be driven by brands taking control over the re-commerce and circularity of their brand’s own products, using enterprise technology solutions like Archive. The data backs up our thesis and there are numerous examples of how the market is developing. Selfridges estimates that by 2030 45% of transactions will come from products made with recycled materials or resales, repairs, or refills. In the same timeframe, LVMH estimates that 25% of its profits, or $3 billion, will come from similar “circular” services.

Differentiated Business Model

Archive offers software products for the entire resale ecosystem that drive unique Archive network effects. Archive’s superior tech and customization enable its brand partners to maximize their resale business and recapture revenue they are losing to third-party resale/re-commerce platforms. Prior to the closing of this most recent round, Archive has demonstrated its ability to rapidly develop and launch new products that keep it ahead of the market and competitors. Archive is focused on making resale and circularity a profit center for brands by leveraging its modular tech solutions and its asset-light business model.

Efficient Customer Acquisition & Retention

BCG research estimates that:

- 71% of secondhand buyers purchase from brands whose new products are unaffordable to them.

- 45% of consumers state that they are more likely to shop brands that offer secondhand along with new products.

- 66% of consumers say they are willing to pay more for sustainable brands.

More and more consumers understand landfill issue and other environmental challenges that the apparel industry is trying to confront. Many consumers expect brands to offer circularity as part of the overall customer experience. Archive offers its brand partners a way to drive new customer acquisition on the buyside, and retention of existing customers through loyalty programs tied to the resale of brand products, on a profitable basis to both the consumer and the brand. Archive’s technology solutions allow consumers who cannot afford a brand’s full-priced items to purchase gently used items and enter the brand’s community.

Positive Environmental Impact

The Archive platform allows brands to incorporate resale into their business to increase customer loyalty and drive new revenue without increasing production. Co-founder Emily Gittins explained that from her climate change mitigation graduate studies, she learned that 8% of global greenhouse gas emissions were generated by the fashion industry. This understanding was one of the drivers of her ambition to build Archive. By powering brands to sell their pre-owned products, Archive helps keep textiles out of landfills longer and lessens pollution from the production of new garments, according to Built In.

An important investment theme for us is addressing growing consumer demand for sustainable purchasing options. Consumers across demographic categories are increasingly embracing re-commerce shopping habits across all categories and price points. Archive is a direct hit on that target investment theme for us.

Conclusion

Over the last nearly six years since we launched Fernbrook, we have worked diligently to position ourselves to be regarded as a value-added partner to founders who are building innovative software, services, tools, and products across the global ecommerce ecosystem.

We focus on leveraging our decades of operating and investing expertise and deep, global relationship network to help our portfolio companies scale. We utilized our deep industry relationships to assist with business development introductions and we received a significant allocation in the Series A round.

Like another portfolio company we recently wrote about, Lily Ai, Archive Resale is an excellent example of how our reputation for rolling up our sleeves and helping a software company with business development is getting us allocations in competitive rounds.

We are looking forward to continuing our partnership with Archive.

January 5, 2023

Share this Article